SHANGHAI—China's government said it would turn a new free-trade zone here into a laboratory for remaking the country's financial sector, but major changes are still years off—if they come at all—as regulators debate how much control to cede to market forces.

On Friday, the State Council, the government's top policy-making body, released rules to govern the China (Shanghai) Pilot Free Trade Zone, a nearly 29 square-kilometer (11 square-mile) patchwork of docks, hangars and warehouses in Shanghai's Pudong district.

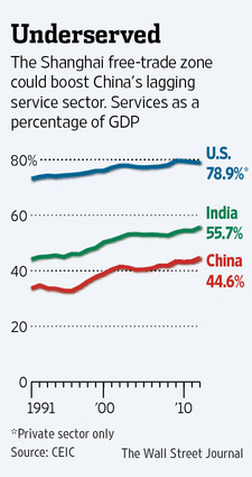

Revamping the financial sector so consumers can get better returns at banks and invest overseas, while smaller Chinese firms, especially service and high-tech firms, have more access to loans is seen as crucial to continued strong growth.

In other sectors, the government pledged to open up shipping, commerce, specialized services, including the legal, travel and executive-placement fields.

Thus, the zone has the potential to be a game-changer for China—or a huge disappointment.

"Reform is easier said than done," said UBS economist Wang Tao. "Which politician, no matter how strong a mandate they get, can really push serious reforms [quickly]."

The zone is going into operation about a month ahead of a Communist Party assembly that is supposed to unveil a strategy for changing China's economy so that it relies more on domestic demand and innovation and less on exports and investment in infrastructure.

Some would-be investors in the zone said they figured it would take authorities five to seven years to figure it all out.

Illustrating the lack of clarity, some foreign publications reported this week that the Shanghai zone or another zone in Shenzhen, called Qianhai, would have freer Internet access. The State Council's statement didn't address that issue, but did lay out a plan to let foreign firms based there offer some Internet services in the country.

As for the Qianhai Economic Zone in Shenzhen, a spokesman, Wang Jinhai, said changes regarding Internet access might come in five or six years to meet "modern international financial communications needs."

So far, all that has changed at the Shanghai free-trade zone are the traffic signs announcing the area's new name.

Even so, stock prices of firms doing business in the zone have climbed. China's top four banks--Industrial & Commercial Bank of China Ltd., (601398.SH +0.26%) China Construction Bank Corp., (601939.SH 0.00%) Agricultural Bank of China Ltd. (601288.SH 0.00%) and Bank of China Ltd. (601988.SH +0.36%) —and other national banks have applied to set up or expand operations in the zone. So have some large foreign banks, including HSBC (0005.HK +0.18%) .

For some firms with large operations in Shanghai, opening a branch in the trade zone may only require a small investment. Foreign firms figure that eased regulation could boost their foreign-exchange operations and give them a bigger share of the domestic bond market.

For domestic banks, said one official, the zone will give them an opportunity to expand abroad and to experiment with market-set deposit rates instead of those mandated by the central bank, which could produce more competition.

Regulators also would face new challenges. The financial-sector changes are only supposed to apply in the zone. But it is unclear how banks there offering higher interest rates will keep ordinary Chinese from figuring out ways to get the same higher rates.

Similarly, if firms in the zone can convert large amounts of yuan into dollars for use abroad, there is bound to be pressure from outside the zone for similar privileges.

Some bankers figure that loopholes are bound to develop—and that regulators will then be able to judge how much they want to deregulate financial markets outside the zone.

Over the past few years, something similar to that occurred when regulators turned a blind eye to banks offering so-called wealth-management products—funds invested in a variety of instruments—that pay higher rates than bank deposits.

But that was a mixed success. Much of those funds boosted the so-called shadow-banking sector, which invested in real estate and infrastructure projects that couldn't get ordinary bank financing because they were viewed as too risky. Critics say that has fed a credit binge in China that has made the country more vulnerable to financial shocks.

Mr. Li isn't the first Chinese leader to promote a free-trade zone. In 1980, China's then-paramount leader, Deng Xiaoping, turned Shenzhen, north of Hong Kong, into a "special processing zone"—essentially walling it off from the rest of the country and allowing foreign firms to use low-cost Chinese labor for manufacturing there.

The zone was a huge success and was copied elsewhere, helping to turn China into one of the world's largest trading powers.

But advisers to the Shanghai free-trade zone say that copying Deng's idea today is as much a show of weakness as strength. Chinese leaders are focusing on local reforms, they say, because they don't have the strength to confront opponents of change head on, including old-line regulators and state-owned enterprises used to preferential treatment by state-owned banks.

Over the past few years, other local experiments with financial liberalization, in Qianhai, near Shenzhen, and the eastern city of Wenzhou, have been stalled, in part, because of ongoing fights over regulations.

"It's vital that the local government take risks," said Zhou Dewen, head of a small business association in Wenzhou, sometimes called the birthplace of Chinese entrepreneurship. "Shanghai needs to make full use of whatever powers are given to them by the central government."

—Yue Li, Lingling Wei and Grace Zhu contributed to this article.

Corrections & Amplifications

The Shanghai free trade zone covers nearly 29 square kilometers, or 11 square miles. An earlier version of this article stated incorrectly it was 29 kilometers, or 18 miles.

RSS Feed

RSS Feed